The MTMIS Punjab (Motor Transport Management Information System) is the official online vehicle verification system introduced by the Punjab Excise & Taxation Department.

Through this digital platform, users can instantly check vehicle registration, ownership details, token tax status, challan history, engine/chassis information, and more.

If you are planning to buy a used car or bike, verifying the vehicle through MTMIS Punjab is the most important step to avoid fraud or tampered documents.

This 2025 updated guide explains how to verify any vehicle, new system features, token tax details, and the latest verification procedure.

What Is MTMIS Punjab? (2025 Overview)

MTMIS Punjab is an online verification portal that allows users to:

- Check vehicle registration

- Confirm current owner details

- Verify token tax status

- View challan & case history

- Check engine and chassis records

- Confirm vehicle authenticity

- Detect duplicate or tampered vehicles

The system is fully connected with the Punjab Excise Department and updates data regularly.

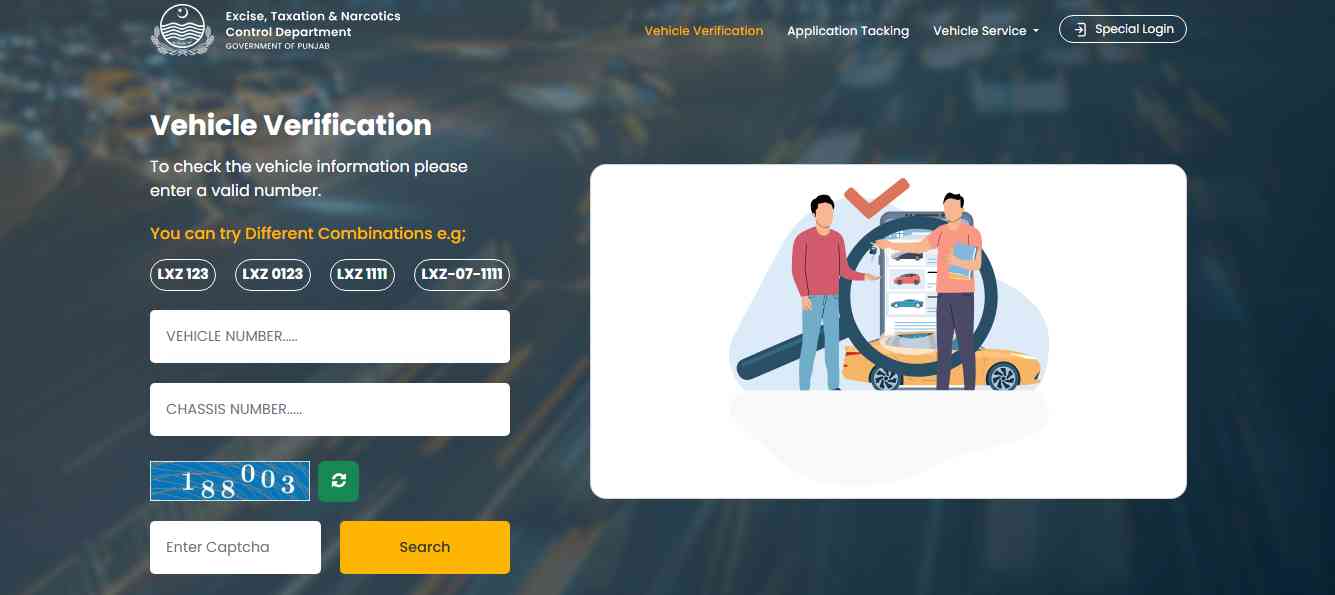

How to Check Vehicle Verification Through MTMIS Punjab (Step-by-Step)

Follow these updated 2025 steps:

Step 1:

Visit the official Punjab Excise MTMIS portal.

Step 2:

Enter your vehicle’s registration number (e.g., LEA-1234).

Step 3:

Click on the Search / Verify button.

Step 4:

The system will display complete details, including:

- Owner name

- Registration number

- Engine number

- Chassis number

- Make & model

- Year of manufacturing

- Token tax status

- Challan record

- Vehicle classification

- Registration city

- Legal case (if any)

Step 5:

Verify all details before purchasing or transferring any vehicle.

MTMIS Punjab 2025 – Latest System Updates

The Punjab government has upgraded the MTMIS system with new enhancements:

- Faster verification

- Updated token tax structure

- More accurate ownership records

- Improved challan history

- Better mobile-friendly interface

- Integration with Safe City data

- Enhanced security & validation features

These improvements make the verification process more reliable and transparent.

Why Vehicle Verification Is Important in Punjab

Vehicle verification helps you:

- Avoid fraudulent or stolen vehicles

- Detect tampered engine/chassis numbers

- Check pending token tax

- Confirm original ownership

- Inspect challan and legal history

- Protect yourself from documentation scams

This is essential when buying a used vehicle in Pakistan.

Punjab Token Tax Rates for Private Motor Cars (2025-2026)

| Engine Capacity (CC) | Annual Token Tax (MVT) (PKR) | Income Tax (Filer) (PKR) | Income Tax (Non-Filer) (PKR) | Professional Tax (PKR) |

|---|---|---|---|---|

| **Up to 1000 CC** | **20,000 (Life Time Tax)** | 10,000 | 30,000 | 200 |

| 1001 to 1199 CC | 0.2% of Invoice Price OR **1,800** | 1,500 | 4,500 | 200 |

| 1200 to 1299 CC | 0.2% of Invoice Price OR **1,800** | 1,750 | 5,250 | 200 |

| 1300 CC | 0.2% of Invoice Price OR **1,800** | 2,500 | 7,500 | 200 |

| 1301 to 1499 CC | 0.2% of Invoice Price OR **6,000** | 2,500 | 7,500 | 200 |

| 1500 CC | 0.2% of Invoice Price OR **6,000** | 3,750 | 11,250 | 200 |

| 1501 to 1599 CC | 0.2% of Invoice Price OR **9,000** | 3,750 | 11,250 | 200 |

| 1600 to 1999 CC | 0.2% of Invoice Price OR **9,000** | 4,500 | 13,500 | 200 |

| 2000 CC | 0.2% of Invoice Price OR **9,000** | 10,000 | 30,000 | 200 |

| 2001 to 2500 CC | 0.3% of Invoice Price OR **12,000** | 10,000 | 30,000 | 200 |

| Above 2500 CC | 0.3% of Invoice Price OR **15,000** | 10,000 | 30,000 | 200 |

**Note:** Vehicles up to 1000 CC are subject to a **Life-Time Token Tax** paid only once at the time of initial registration. Other taxes shown are applicable annually.

How to Check Token Tax Status in MTMIS Punjab

- Open the official MTMIS Punjab portal

- Enter the vehicle number

- Scroll down to the “Token Tax Status” section

- You’ll see:

- Paid/Unpaid status

- Last payment date

- Next due date

- Challan summary

Ownership Transfer Verification (New Policy 2025)

The MTMIS Punjab portal now shows:

- Transfer requested

- Transfer processing

- Transfer approved

- Pending documents

- Case history

This helps buyers verify the actual legal owner of any vehicle.

Safety Tips Before Buying a Used Vehicle in Punjab

When buying a used vehicle, always check MTMIS Punjab records. Also, ensure the car has high-quality alloy rims for safety and performance

- Always check MTMIS record

- Compare physical engine/chassis number

- Verify token tax dues

- Check smart card or registration file

- Inspect seller’s CNIC information

- Avoid handwritten registration books

- Check FIR or challan record

These steps protect you from fraud and fake documents.

Frequently Asked Questions (FAQs)

Q1: Is MTMIS Punjab data accurate?

Yes, it is directly synced with the Punjab Excise Department.

Q2: Does MTMIS show the owner’s CNIC number?

No, CNIC information is hidden for privacy reasons.

Q3: Can motorcycles be verified on MTMIS Punjab?

Yes, all vehicles including bikes can be verified.

Q4: What if “Record Not Found” appears?

It may indicate incomplete data or an unregistered vehicle — visit the Excise office.

Q5: Can token tax be paid online?

Yes, through the Punjab ePay App.

Conclusion

MTMIS Punjab is a powerful and essential system for safe used vehicle buying in Pakistan.

By using this 2025 updated online verification method, you can easily check ownership records, token tax, challans, and complete vehicle details.

This guide helps you stay safe, informed, and protected while dealing with vehicle transactions in Punjab.